According to a top executive, Arkam Ventures' second venture capital fund will focus on electric vehicles manufacturing, in addition to fintech, skilling, software-as-a-service, logistics, and food agriculture. Further, as per Bala Srinivasa, managing director at Arkam Ventures, the second fund has a multi-fund thesis. "In this fund, you will find a diverse range of sectors linked by the digitization thesis." We've added manufacturing and electric vehicles because we believe there are more pressing issues that need to be addressed."

Arkam Ventures, which has made investments in startups such as business-to-business marketplace Jumbotail, investing startup Jar, and financing platform Kreditbee, raised $180 million in its second fund last year. This fund's fundraising is currently being completed by the firm.

Arkam made its first investment in the manufacturing market on Tuesday, co-leading a $6.3 million Series A funding round in custom manufacturing platform Karkhana.io alongside Susquehanna Asia Venture Capital.

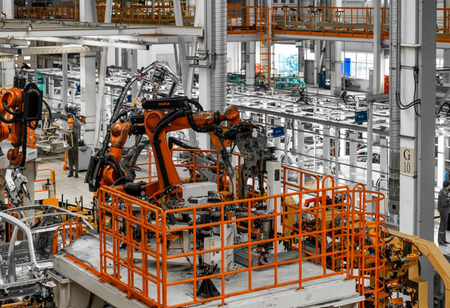

Karkhana.io provides contract manufacturing solutions in areas such as product assembly and product localization.

"Everybody has come to the conclusion that more transparency, visibility and higher quality needs to be done through technology, and that's what drove us into investing in a platform like Karkhana," Srinivasa, the CEO of Srinivasa

Arkam's first fund was used to fund Karkhana.

Arkam, which was created by former Kalaari Capital partner Srinivasa and former Helion Venture managing director Rahul Chandra, completed its first fund in April 2022 for $106 million.

Regarding the manufacturing sector, Srinivasa stated that while gestation times are long and entrance barriers may be difficult to overcome, customer stickiness is stronger than for other types of digital firms.

"The most difficult challenge for manufacturing startups is ensuring that they can take product-market fit." It takes longer to prove it, therefore you need a lot more grip and skill to persuade investors to stay in the game."

According to Srinivasa, the environment is favourable for manufacturing startups due to investor interest and tailwinds such as expanding local demand and the 'China Plus One' strategy. The 'China Plus One' approach encourages enterprises to diversify their sourcing locations in order to lessen their reliance on China.

"If small Indian businesses can't become large manufacturing enterprises, the contribution that they make cannot keep pace with the growing demand, and it would be a lost opportunity," said Mr. Singh.

Srinivasa highlighted three issues that small enterprises in manufacturing face when it comes to sourcing demand, capital, and capacity utilisation when discussing the necessity for digital platforms in manufacturing.

"An average factory in India has 30-40% unused capacity because of the demand supply disconnect," said Mr. Singh. "There is a lot more demand today, and small businesses are also aware of the supply chain shift." They are turning to digital platforms to find novel solutions to meet the increased demand."